News & Views

The merger will be the biggest in Indian corporate history and the new entity will create a banking-mortgage giant

India’s leading mortgage financier the Housing Development Finance Corporation (HDFC) and the largest privately-owned bank HDFC Bank have planned the biggest merger in India’s corporate history.

The merger could take in 12-14 months as it needs to get several regulatory approvals, and it will create a banking behemoth. Interestingly, HDFC set up the bank in 1994, but over the years the latter outgrew its parent both in terms of valuation and asset size.

HDFC’s 26% stake in the bank will be extinguished and the new entity will be fully owned by public shareholders. Existing shareholders of HDFC will own 41% of the bank. Every HDFC shareholder will get 42 shares of HDFC Bank for every 25 shares held, according to stock exchange filings by the firms.

To date, HDFC has total assets of 6.23 trillion rupees (US$82.54 billion), while HDFC Bank has assets worth 19.38 trillion rupees ($256 billion). HDFC Bank has a large customer base of 68 million.

HDFC Chairman Deepak Parekh termed it as “a merger of equals.” “We believe that the housing finance business is poised to grow in leaps and bounds due to the implementation of the Real Estate Regulatory Authority, infrastructure status to the housing sector, government initiatives like affordable housing for all, amongst others,” he said.

The HDFC chief also said: “As the son grows older, he acquires the father’s business. This is a friendly merger. We won’t be thrown out. After 45 years in housing finance, we have to find a home for ourselves which we found in our own family company HDFC Bank.”

The merger will provide HDFC Bank with a huge corpus of mortgage portfolios and an increased presence in semi-urban and rural areas. HDFC Bank CEO Sashidhar Jagdishan said: “The biggest motivation for the deal is creating demand in the housing market as our penetration in this segment is very low.”

Deepak Parekh said the harmonization of rules between banks and shadow banks, which reduces the regulatory arbitrage, was one of the key factors which influenced the decision to merge between the largest home financier and HDFC Bank.

S&P Global Ratings said this merger will make HDFC Bank twice the size of its nearest private-sector rival ICICI Bank. However, the state-owned State Bank of India will continue to remain the largest lender in the country.

The combined market capitalization of 14 trillion rupees will enable HDFC Bank to overtake Tata Consultancy Services and attain the second position in valuation after Reliance Industries (18 trillion rupees).

The bank will continue to be led by the current management and Sashidhar Jagdishan will remain as the CEO. Deepak Parekh, 77, will not be on the board of the merged entity as the Reserve Bank of India does not allow anyone above 75 years to be on the board of a bank.

By KS Kumar

Source: https://asiatimes.com/2022/04/indias-hdfc-and-hdfc-bank-plan-a-mega-merger/

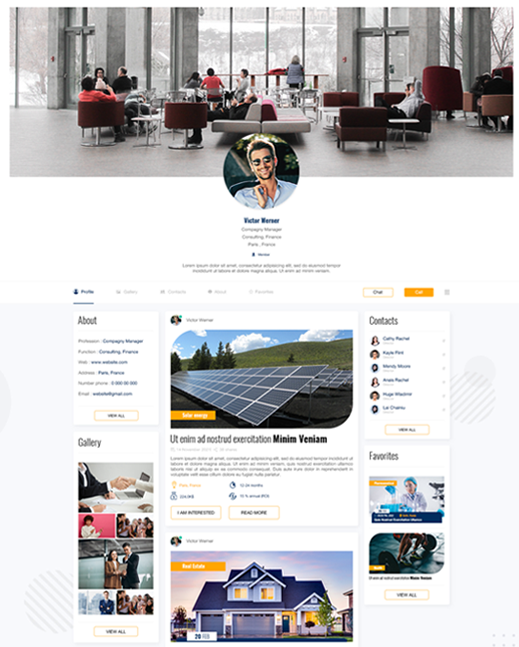

How to join Oxentt ?

To join the exclusive Business Agency elite group does not require important financial contribution. It is, however, imperative that by joining all members adhere to its philosophy of ethics, respect and seriousness.

Any business owner from any country, investor, entrepreneur and corporate executives are welcome to join us.