News & Views

It's all going up: electricity, diesel, vegetables, the Internet, hotels, flights, and now, interest rates.

Russia's invasion of Ukraine, the worldwide energy crisis, on-and-off lockdowns in China and pandemic-era supply bottlenecks have come together to produce an explosive cocktail of spiralling prices.

Everything, it seems, is becoming impossibly expensive.

In an almost synchronised manner, central banks from all around the world are rushing to raise their key interest rates in a bid to tame high inflation, which, much to their dismay, continues to break monthly records.

The European Central Bank (ECB) has bumped rates three times in four months, putting an abrupt end to a long chapter of negative rates dating back to the worst years of the EU's sovereign debt crisis

Its counterparts in the UK, Sweden, Norway, Canada, South Korea and Australia have all taken similar steps in reaction to daunting inflation readings.

The Federal Reserve of the United States has delivered three consecutive jumbo hikes of 0.75 basis points, with similar moves coming down the pipeline.

But what exactly is the rationale behind this move?

Central banks are public institutions of a unique nature: they are independent, non-commercial entities tasked with managing the currency of a country or, in the case of the ECB, a group of countries.

They have exclusive powers to issue banknotes and coins, control foreign reserves, act as emergency lenders and guarantee the good health of the financial system.

A central bank's prime mission is to ensure price stability. This means they need to control both inflation – when prices go up – and deflation – when prices go down.

Deflation depresses the economy and fuels unemployment, so every central bank sets a target of moderate, positive inflation – usually around 2% – to encourage gradual, steady growth.

But when inflation begins to skyrocket, the central bank is in deep trouble.

Excessive inflation can rapidly shatter the benefits reaped in previous years of prosperity, erode the value of private savings and eat up the profits of private companies. Bills become an uphill struggle for everybody: consumers, businesses and governments are all left to scramble to make ends meet.

"High inflation is a major challenge for all of us," ECB President Christine Lagarde has said.

This is the moment when monetary policy comes into play.

A banker's bank

Commercial banks, the ones we go to when we need to open an account or take out a loan, borrow money directly from the central bank to cover their most immediate financial needs.

Commercial banks have to present a valuable asset – known as collateral – that guarantees they will pay this money back. Public bonds, the debt issued by governments, are among the most frequent forms of collateral.

In other words, a central bank lends money to commercial banks, while commercial banks lend money to households and businesses.

When a commercial bank gives back what it borrowed from the central bank, it has to pay an interest rate. The central bank has the power to set its own interest rates, which effectively determines the price of money.

These are the benchmark rates that central banks are currently raising to tame inflation.

The logic is based on a cascading effect: if central banks charge higher rates to commercial banks, commercial banks in turn increase the rates they offer to households and businesses who wish to borrow.

As a result, personal debt, car loans, credit cards and mortgages turn costlier and people become more reluctant to request them.

Companies that regularly ask for credits to make investments begin to think twice before making a move. Meanwhile, governments are forced to make higher payments for their national debt.

Tighter financial conditions inevitably lead to a fall in consumer spending across most or all economic sectors.

Fundamental economic rules show that when demand for goods and services declines, prices follow suit. This is exactly what central banks intend to do at present: curb spending to curb inflation.

But the effects of monetary policy can take up to two years to materialise and are therefore unlikely to offer an immediate solution to the most pressing challenges.

Complicating matters is the fact that energy is currently the main driver behind inflation, fuelled by a factor totally unrelated to the economy: Russia's unprovoked invasion of Ukraine.

Electricity and gasoline are commodities that most people use regardless of how much they cost, so a quick and drastic drop in demand to cool prices cannot be taken for granted.

This explains why central banks, like the Fed, are taking such radical steps, even if it ends up hurting the economy. Aggressive monetary policy is a tightrope walk: making money more expensive can slow down growth, weaken salaries and foster unemployment.

"The chances of a soft landing are likely to diminish to the extent that policy has to be more restrictive," US Federal Reserve chair Jerome Powell has said.

"No one knows whether this process will lead to a recession or, if so, how significant that recession would be."

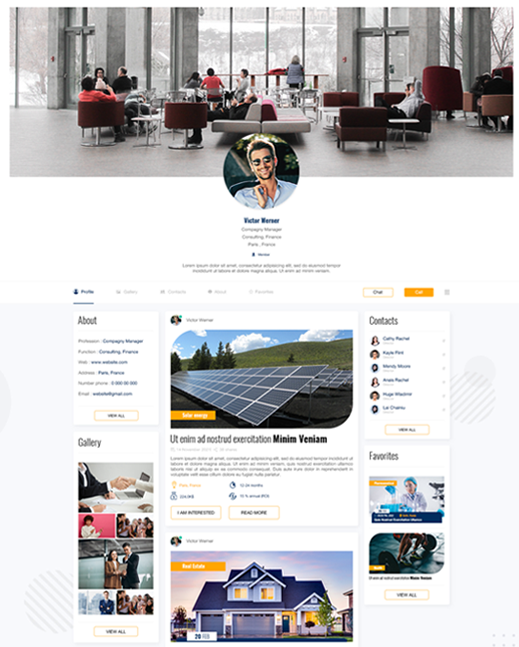

How to join Oxentt ?

To join the exclusive Business Agency elite group does not require important financial contribution. It is, however, imperative that by joining all members adhere to its philosophy of ethics, respect and seriousness.

Any business owner from any country, investor, entrepreneur and corporate executives are welcome to join us.