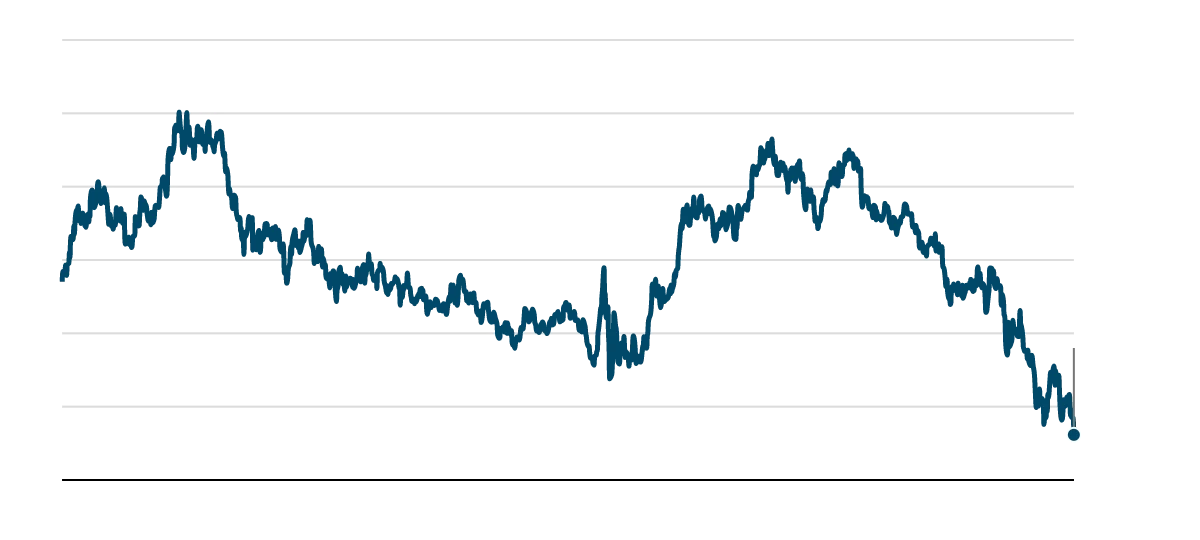

Natural gas prices in Europe are at their highest level since March. Russia has cut flows of gas to Europe, and the major Nord Stream pipeline is about to undergo maintenance. Energy workers in Norway have just gone on strike, threatening further supply constraints.

"We have an upcoming winter crisis for the euro zone and I expect energy prices will remain very strong," Rochester said.

The euro tends to perform poorly when risk appetite among investors pulls back.

Another issue is trade. Germany just reported a rare monthly trade deficit, a sign that high energy prices are weighing on manufacturers in Europe's export powerhouse. A weaker euro then becomes necessary to make the bloc's exports more competitive.

Europe has also been behind the United States in raising interest rates, though the European Central Bank expects to begin hiking this month. That means investors are more likely to park their money in the United States, where they can net better returns.

As interest rates climb, there are concerns that bond markets in countries with high debt loads like Italy and Greece could

come under strain. The ECB has said it will work to prevent what it refers to as "fragmentation," but it remains a risk traders are monitoring closely.

Clients "are very concerned about all things European," Societe Generale strategist Kit Juckes said Tuesday. "Germany's trade data yesterday went down badly, and the sense that the current account surplus is being battered by energy prices is widely spread. Add in worries about fragmentation and fear that the global economy is turning south, and it's hard to get even slightly upbeat about the euro."

It's Bezos vs. the White House vs. inflation

Decades-high inflation has the White House's attention as it tries to assure Americans that it's taking price increases seriously. That's ramped up finger-pointing at Corporate America, which the Biden administration says is making the problem worse.

"My message to the companies running gas stations and setting prices at the pump is simple: this is a time of war and global peril," President Joe Biden tweeted over the holiday weekend. "Bring down the price you are charging at the pump to reflect the cost you're paying for the product. And do it now."

That sparked an outcry from Amazon founder Jeff Bezos, who has been increasingly outspoken on Twitter.

"Ouch. Inflation is far too important a problem for the White House to keep making statements like this," he tweeted in response. "It's either straight ahead misdirection or a deep misunderstanding of basic market dynamics."

Veteran venture capitalist Bill Gurley also jumped into the fray. He said he "totally" agreed with Bezos, pointing to "the past three hundred years of economic research and understanding."

The White House pushed back on the criticism.

"Oil prices have dropped by about $15 over the past month, but prices at the pump have barely come down. That's not 'basic market dynamics.' It's a market that is failing the American consumer," Press Secretary Karine Jean-Pierre said on Twitter. "But I guess it's not surprising that you think oil and gas companies using market power to reap record profits at the expense of the American people is the way our economy is supposed to work."

Checking the numbers: US oil prices have pulled back over the past month as recession fears have come to the fore. West Texas Intermediate futures, the benchmark, were last trading at about $108.50 per barrel, compared to over $118.50 a month ago. That $10 difference is smaller than the White House's number.

Yet it's true there hasn't been overwhelming relief at the pump. The average price of a gallon of regular gasoline is $4.80. One month ago, it was $4.85, compared to $3.13 one year ago.

Is that the result of price gouging? Perhaps in select cases. But the biggest drivers of fuel prices right now are elevated demand and limited supply, particularly of gas and diesel. That's the result of disruptions from the pandemic, the war in Ukraine and the arrival of summer driving season in the northern hemisphere. Lack of investment in refining capacity is also exacerbating the issue.

$380 oil? JPMorgan sees a scenario where that's possible

Shortly after Russia invaded Ukraine, global oil prices surged above $139 a barrel. They were last trading below $113. But strategists at JPMorgan Chase see a possible scenario in which "stratospheric" $380 crude could be on the cards, making recent gains look puny by comparison.

Step back: Last week, G7 leaders agreed to hash out a plan to cap the price of Russian oil. This would allow the country's discounted barrels to keep hitting the market but reduce Moscow's revenue.

Details are still being nailed down. But in theory, to receive insurance from Western companies for their cargoes, customers like China and India would agree to pay only $50 to $60 per barrel.

That would curb income for the Kremlin, which has estimated the price of its export barrels will top $80 by the end of 2022.

But JPMorgan's team, including strategist Natasha Kaneva, warns that Russia could retaliate by intentionally curbing oil output as it's done with natural gas. That would send prices through the roof. If it slashed production by 3 million barrels per day, the bank forecasts prices could jump to $190 per barrel. In a "worst-case scenario" of a cut of 5 million barrels per day, prices could hit $380.

"If the geopolitical situation requires, it now appears more likely that export cuts could be used as leverage / policy tool, in our view," Kaneva and colleagues wrote this month.