News & Views

The agency that oversees Wall Street has proposed major changes to the way millions of everyday investors buy and sell stocks. That could be bad news for so-called free-trading apps like Robinhood as well as the lesser known firms that underpin their business models.

Trading could be made fairer for everyday retail investors with some tweaks to the stock market's plumbing, Securities and Exchange Commission Chair Gary Gensler said at the Piper Sandler Global Exchange Conference in Washington Wednesday. Gensler asked the SEC to consider giving retail traders access to some of the perks available only to the biggest players on Wall Street, including the ability to buy stocks for fractions of a penny, get better visibility into the market's mechanics and invite more buyers and sellers to ensure everyday investors are getting the best price on a purchase or sale.

Among Gensler's biggest proposed changes is a quirk in the stock market that was exposed during the meme stock mania a year ago.

Today, when you buy or sell a stock on an app, the trade appears to be instantaneous. But beneath that simple buy/sell action is a complex web of Wall Street players exploiting tiny differences in price to rake in huge amounts of cash.

Here's how it works: When you tap buy or sell, Robinhood (or your broker of choice), takes your order to a firm known as a wholesaler or market maker — the middlemen who are supposed to get you the best price and who pay the brokers for the privilege of executing the trades. They typically make pennies off each transaction.

That process is known as "payment for order flow," and it has come under intense scrutiny by regulators following the fallout from the January 2021 run-up in meme stocks like GameStop.

The GameStop frenzy "exposed how rigged the US equity markets are to enrich big Wall Street firms, high frequency trading firms and brokers at the expense of Main Street retail investors," Better Markets CEO Dennis Kelleher wrote at the time.

The Securities and Exchange Commission has been reviewing the system, which accounts for the bulk of the brokerages' revenues. In August last year, Robinhood's stock tumbled after Gensler said that an outright ban of payment for order flow was "on the table."

Gensler and other critics of the process say the brokers and market makers, such as Citadel Securities, have a clear conflict of interest, and that payment for order flow screws over everyday investors while amassing huge wealth for Wall Street firms.

The SEC is considering whether to add more competition at the middleman level to ensure retail investors are actually getting the best prices. In that scenario, orders would be routed into auctions where trading firms would have to compete to execute them.

"It's not clear, with such market segmentation and concentration, and with an uneven playing field, that our current national market system is as fair and competitive as possible for investors," Gensler said Wednesday.

For example, Gensler noted that retail investors buy stocks at penny increments, but wholesalers can buy stocks for increments of fractions of a penny. With high volume, that gives wholesalers an advantage and generates huge profits.

"It raises real questions about whether this structure is fair and best promotes competition," Gensler said. "Why not allow all venues to have an equal opportunity to execute at sub-penny increments?"

Gensler also proposed giving investors in small numbers of shares similar visibility into the markets that big traders receive.

A spokesperson for Robinhood didn't comment specifically on the potential changes but pointed to research from MIT that shows retail investors saved more than $17 billion in trading fees thanks to free-trading apps 2020 and 2021.

In response to Gensler's comments, Robinhood defended its business no-fee model, saying it has saved investors billions of dollars.

"American retail investors enjoy one of the most efficient, low-cost investing environments in history," said Dan Gallagher, Robinhood's chief legal, compliance and corporate affairs officer, in a statement. "We look forward to reviewing the Commission's eventual rule proposal and engaging with the SEC during a meaningful notice and comment rulemaking process."

Robinhood shares were down nearly 4% Wednesday afternoon.

Source: Edition CNN

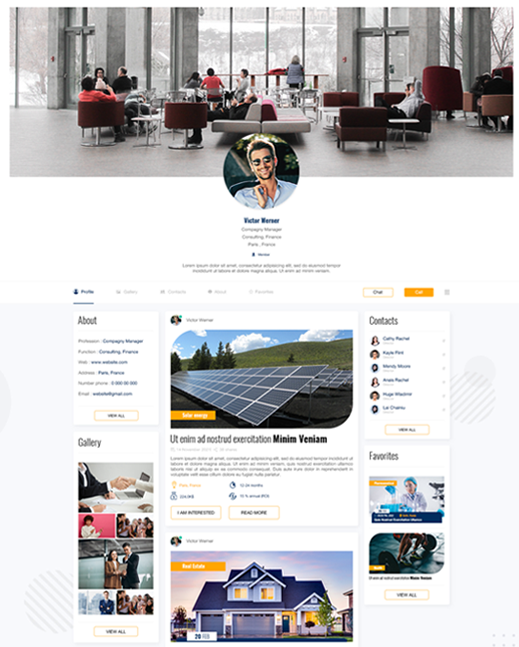

How to join Oxentt ?

To join the exclusive Business Agency elite group does not require important financial contribution. It is, however, imperative that by joining all members adhere to its philosophy of ethics, respect and seriousness.

Any business owner from any country, investor, entrepreneur and corporate executives are welcome to join us.